Buying Crypto from Exchanges

How It Works

Coinbase, Binance, Kraken and many others provides cryptocurrency exchanges that enable their users buy, sell and trade different digital assets directly. These platforms perform intermediary functions by helping the transactions take place between buyers an sellers.

Advantages

1. Direct Ownership

While buying cryptos from exchanges, investors do not own the digital assets in real sense. Such indirect ownership makes it impossible to have control over the investment for example you cannot transfer it to another person or store it on your PC when you wish to do so.

2. Wide Range of Options

Exchange trading is characterized by the fact that there is a great wealth of cryptocurrencies, starting with Bitcoin and Ethereum and ending with different altcoins. This diversity gives traders/investors a possibility to avoid risks through portfolio diversification.

3. Immediate Transactions

When trades are executed on exchanges, they are usually transacted promptly which in turn gives the investor the opportunity to react quickly to the market fluctuation. The rapidity of this matter can be vital in the crypto market that is very volatile.

4. Lower Fees

In general, purchasing cryptocurrencies directly from exchanges has lower fees than ETFs do. Exchange fees often come only as transaction costs, withdrawal fees and sometimes deposit fees.

5. Passive Income Options

You can earn passive income by cryptocurrency staking and other interest bearing investments.

Disadvantages

1. Security Risks

Hackers often single out cryptocurrency exchanges. Many exchanges have been compromised despite security measures, which has resulted in significant financial losses for users.

2. Storage Responsibility

Investors are obligated to take care of the security of their digital assets which often implies using hardware wallets, cold storage or/and other practice to safeguard their investments.

3. Regulatory Concerns

Cryptocurrency exchanges operate at different levels of regulation depending on the jurisdiction. This may pose problems regarding accessibility, legality and compliance especially for foreign investors.

4. Complexity

This is a touch confusing to people who are just starting off. Grasping what market orders are, operating wallets, and being on watch of market happenings require certain technical level and continuous learning system.

Buying Crypto through ETFs

How It Works

Cryptocurrency ETFs are funds that invest in and trade a group of companies involved in the crypto business. They do this by tracking the value of one or more cryptocurrencies, and exchange traded on stock exchanges. An investor can buy shares in a fund like this and thereby get exposure to what is going on without directly owning any of it.

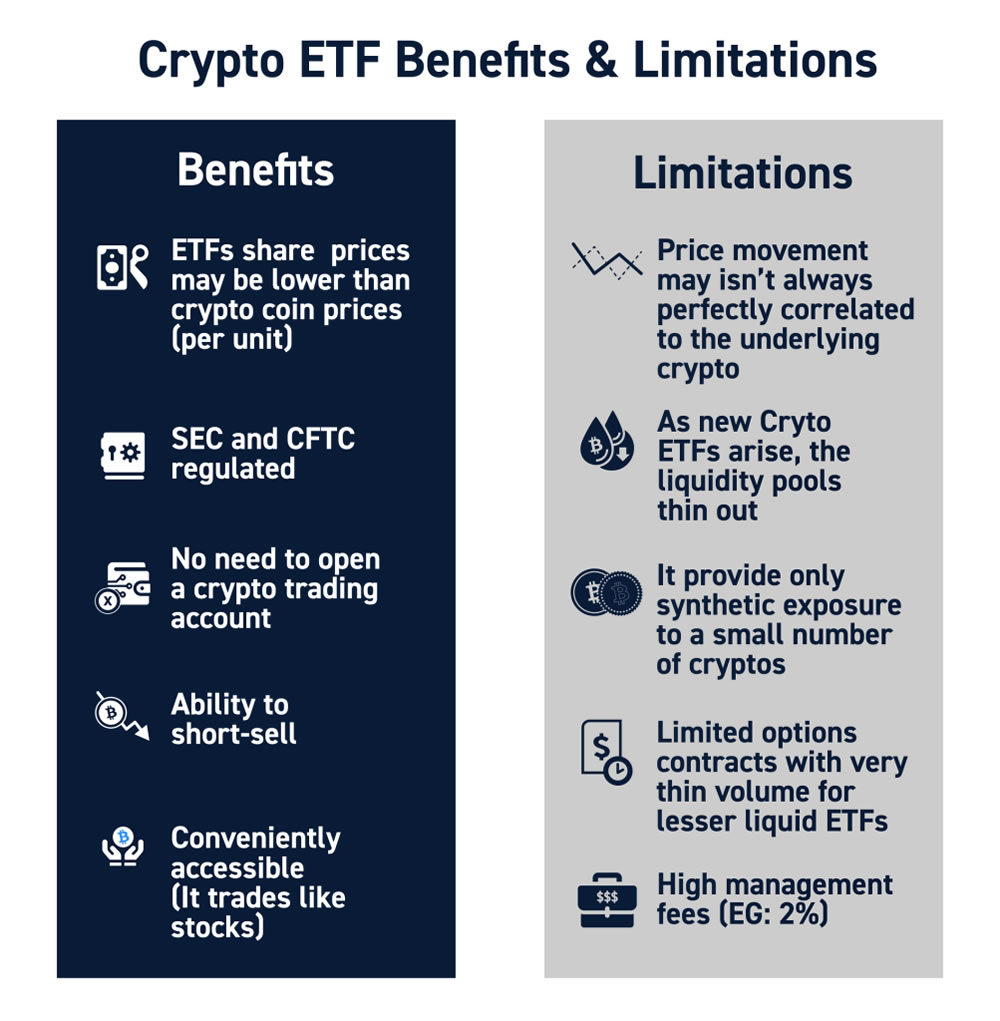

Advantages

1. Simplified Investment

ETFs make it possible for you to invest in cryptocurrencies without the need to actually buy the digital currencies themselves. Investors can acquire such shares through their brokerage accounts hence making their acquisition just as easy as that of stocks or traditional ETFs. This simplicity is most attractive to those who are new to the cryptocurrency market.

2. Professional Management

ETFs are managed by fund managers who are professionals who trade, store and secure investment portfolios. This professional oversight may lessen the risks and burdens related to management of individual crypto investments.

3. Regulatory Oversight

Crypto ETFs usually come with regulatory oversight which in turn gives them a measure of security and legitimacy. This will be quite reassuring to investors worried about the regulatory environment of direct cryptocurrency investments.

4. Diversification

Some crypto ETFs give you exposure to several cryptocurrencies which give you an instant diversification among the digital assets. The acquisitive diversification can help to partially curb the risks associated with the extreme volatility of the single cryptocurrencies.

Disadvantages

1. Indirect Ownership

When investing in crypto ETFs, investors do not own the actual cryptocurrencies. This means they cannot use the digital assets for transactions, staking, or other purposes specific to cryptocurrencies.

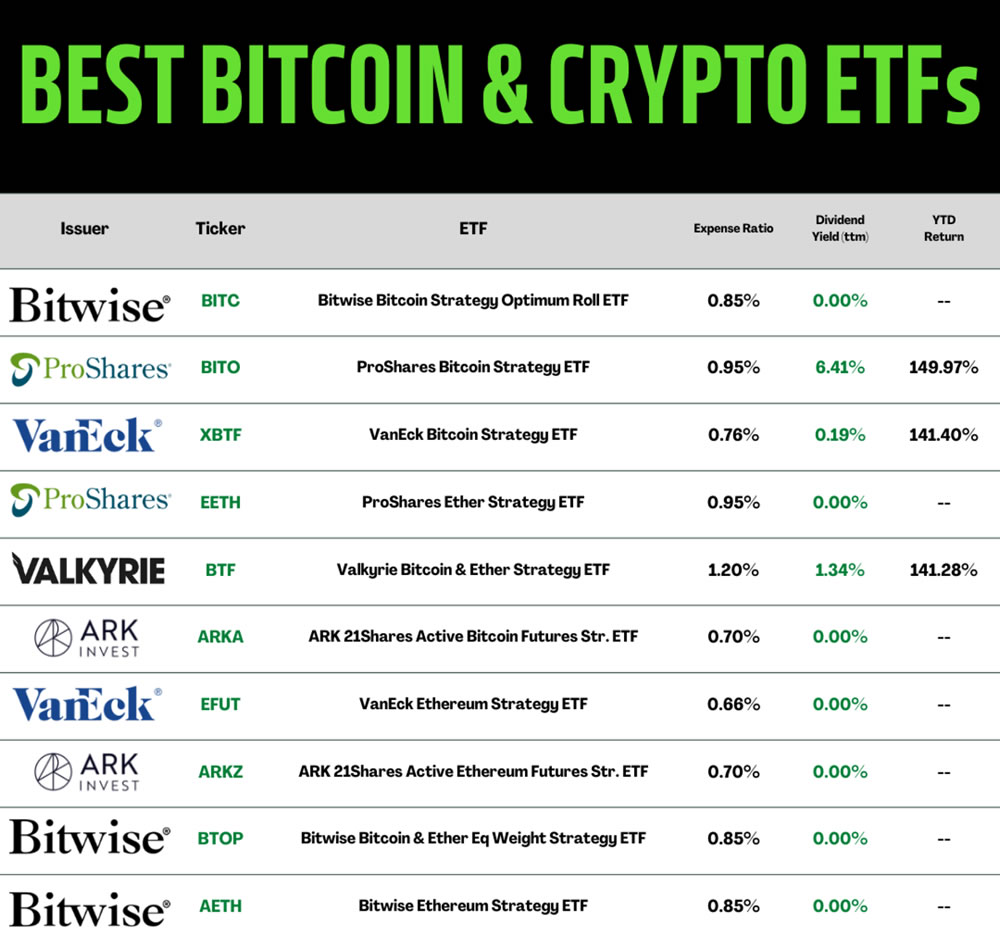

2. Management Fees

ETFs typically charge management fees, which can eat into investment returns over time. These fees are in addition to any brokerage fees associated with buying and selling ETF shares.

3. Limited Choices

The range of available crypto ETFs is relatively limited compared to the vast number of cryptocurrencies available on exchanges. Investors may not find ETFs that align perfectly with their desired exposure or investment strategy.

4. Market Hours

Unlike cryptocurrency exchanges that operate 24/7, traditional stock exchanges have fixed trading hours. This limitation can prevent investors from reacting immediately to after-hours or weekend market movements.

Conclusion

Both buying crypto from exchanges and through ETFs offer unique benefits and drawbacks. Direct ownership through exchanges provides greater control and a wider range of investment options but comes with higher security and complexity risks. On the other hand, crypto ETFs offer a simplified, professionally managed investment experience with regulatory oversight, but at the cost of management fees and indirect ownership. By considering their investment goals, risk tolerance, and technical expertise, investors can choose the approach that best suits their needs.